SOURCE: DR HOUSING BUBBLE

If you bought or rented in 2014 a larger portion of your income went to housing. Rents and housing values are quickly outpacing any pathetic gains to be had with wages. With the stock market at a peak, talking heads are surprised when the public is still largely negative on the economy. Can it be that many younger adults are living at home or wages are stagnant? It can also be that our housing market is still largely operated as some feudal operation. Many lucrative deals were done with big banks and generous offers circumventing accounting rules. This works because many perceive they are temporarily embarrassed Trumps, only one flip away from being a millionaire. Why punish financial crimes when you will likely need those laws to protect yourgains once you join the club? The radio talk shows are all trying to convince people to over leverage and buy a home because you know, this time is the last time ever to buy. Yet home sales are pathetic because people don’t have the wages to support current prices. So sales drop and many sellers pull properties off the market. You want to play, you have to pay today. Rents are also rising and this is where a large portion of household growth has occurred. 2015 will continue to see housing consume a large portion of income and will lead many into a new modern day serfdom.

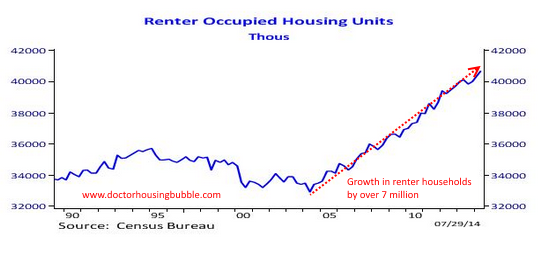

The gain of 7 million rental households

Over the last decade we have added 7 million renting households. Is this because of population growth? No. This trend was driven because of the boom and bust in the housing market. Investors crowded out regular home buyers in buying single family homes and now, we have millions of new renters out in the market. Many of these people are folks who lost their homes via foreclosure.

Take a look at the obvious jump in renters:

For better or worse, homeownership is a path to building equity. It is a forced saving account for many. Most Americans don’t even benefit from the stock market peaking because nearly half of the country doesn’t even own stocks. And many own only a small amount. Most Americans derive their net worth from their primary residence. With fewer buying and more renting, I doubt that on a full scale people are suddenly buying stocks for the long-term. But it is also the case that many are simply renting because that is all they can afford. Many young Americans have so much debt that this is all they can pay. Think of places like San Francisco where jobs pay well but rents are simply out of this world and home prices are nutty.

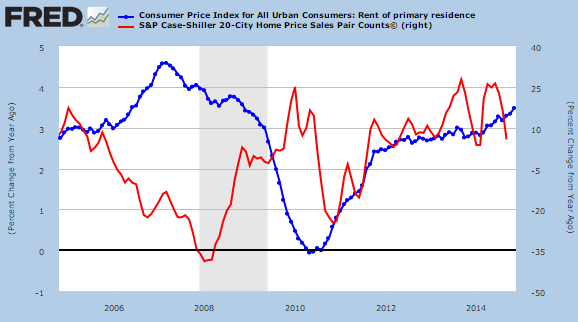

Rents more stable versus wild housing prices

Thanks to low rates, generous tax structures, and the American Dream marketing machine home values are operating in a casino like environment. This wasn’t the case in previous generation but take a look at fluctuations in rents versus home prices:

A crazy year for rents is when rents go up over 4 percent year-over-year. For home values we routinely had year-over-year gains of 25 percent in the last 20 years (including the latest boom in 2013). Rents are driven by net income of local families. No funny leverage here. But with buying homes, you have investors chasing yields, or loans that allow tiny down payments for buyers but then tack on a massive 30 year mortgage with a monthly nut that seems reasonable but only because of a low interest rate. Some of these people have no retirement account yet take on a $600,000 or $800,000 mortgage without batting an eye. So what we find is this psychological shift where some that want to buy are convinced that they need to start at the bottom of the ladder and pay an enormous price tag just to get in. To move out of serfdom, you have to embrace the cult of Mega Debt.

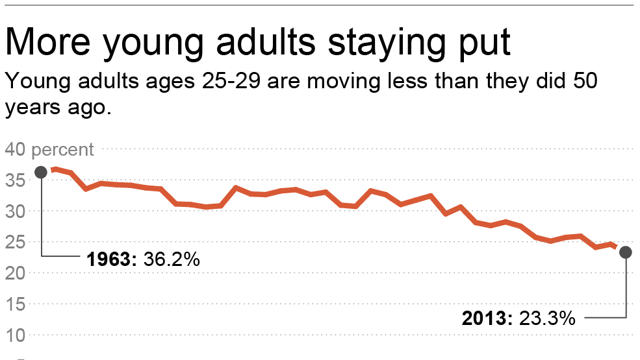

Young adults more likely to stay close to home – and rent

Young adults are facing the biggest impact of the housing crunch. Many are living at home because they can’t even afford current rents. Those that do venture out, will likely rent as their first step. A recent survey found that many young adults are planning on staying local. Say you live with your baby boomer parents in Pasadena or San Francisco. You want to buy like they did but good luck. So many have their network within said community and will likely rent (or live with mom and dad deep into their 30s and 40s):

I found this data interesting. People are simply moving less from their home area. So this will create more demand for rentals in these markets. In California, we have 2.3 million adults living at home. Pent up demand? Unlikely. The main reason they are at home is because of financial constraints. These are people that can’t even afford a rental. I’m sure this trend is occurring in other higher priced metro areas as well.

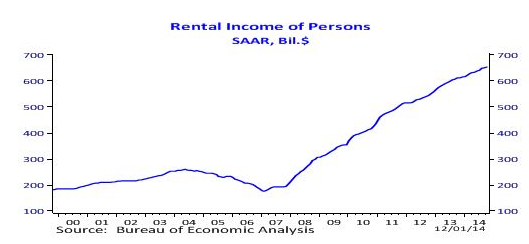

Rental income soaring for investors

Rental income has soared since the bust happened. The biggest winners? Those who bought properties to become the new feudal landlords. You can see by the below chart that there was a larger concerted effort to consolidate rental income beyond the mom and pop buyers of former years:

Serfdom is also occurring to many households buying. They are leveraging every penny into their mortgage payment. Think you own your place? Try missing a few payments and become part of the 7 million completed foreclosures since the crisis hit. 2014 simply saw more net income going into housing. Is this good? Not really since housing is a dud for the economy unless we have new construction being built but that is not happening on a large scale. 2015 will likely see this continuation of serfdom via renting or buying but at least you might save a few bucks with lower oil! The road to serfdom apparently runs through housing.

No comments:

Post a Comment