The Clinton Foundation accepted millions of dollars from seven foreign governments during Hillary Rodham Clinton’s tenure as secretary of state, including one donation that violated its ethics agreement with the Obama administration, foundation officials disclosed Wednesday. Most of the contributions were possible because of exceptions written into the foundation’s 2008 agreement, which included limits on foreign-government donations. The agreement, reached before Clinton’s nomination amid concerns that countries could use foundation donations to gain favor with a Clinton-led State Department, allowed governments that had previously donated money to continue making contributions at similar levels. The new disclosures, provided in response to questions from The Washington Post, make clear that the 2008 agreement did not prohibit foreign countries with interests before the U.S. government from giving money to the charity closely linked to the secretary of state. In one instance, foundation officials acknowledged they should have sought approval in 2010 from the State Department ethics office, as required by the agreement for new government donors, before accepting a $500,000 donation from the Algerian government. The money was given to assist with earthquake relief in Haiti, the foundation said. At the time, Algeria, which has sought a closer relationship with Washington, was spending heavily to lobby the State Department on human rights issues. While the foundation has disclosed foreign-government donors for years, it has not previously detailed the donations that were accepted during Clinton’s four-year stint at the State Department.

Friday, 27 February 2015

Foreign governments, Dictators, Autocrats, Warlords gave millions to Clinton Foundation while Hillary was at State Dept.

The Great Game in the Holy Land - How Gazan Natural Gas Became the Epicenter of An International Power Struggle

Guess what? Almost all the current wars, uprisings, and other conflicts in the Middle East are connected by a single thread, which is also a threat: these conflicts are part of an increasingly frenzied competition to find, extract, and market fossil fuels whose future consumption is guaranteed to lead to a set of cataclysmic environmental crises.

Amid the many fossil-fueled conflicts in the region, one of them, packed with threats, large and small, has been largely overlooked, and Israel is at its epicenter. Its origins can be traced back to the early 1990s when Israeli and Palestinian leaders began sparring over rumored natural gas deposits in the Mediterranean Sea off the coast of Gaza. In the ensuing decades, it has grown into a many-fronted conflict involving several armies and three navies. In the process, it has already inflicted mindboggling misery on tens of thousands of Palestinians, and it threatens to add future layers of misery to the lives of people in Syria, Lebanon, and Cyprus. Eventually, it might even immiserate Israelis.

Resource wars are, of course, nothing new. Virtually the entire history of Western colonialism and post-World War II globalization has been animated by the effort to find and market the raw materials needed to build or maintain industrial capitalism. This includes Israel's expansion into, and appropriation of, Palestinian lands. But fossil fuels only moved to center stage in the Israeli-Palestinian relationship in the 1990s, and that initially circumscribed conflict only spread to include Syria, Lebanon, Cyprus, Turkey, and Russia after 2010.

The Poisonous History of Gazan Natural Gas

Back in 1993, when Israel and the Palestinian Authority (PA) signed the Oslo Accords that were supposed to end the Israeli occupation of Gaza and the West Bank and create a sovereign state, nobody was thinking much about Gaza's coastline. As a result, Israel agreed that the newly created PA would fully control its territorial waters, even though the Israeli navy was still patrolling the area. Rumored natural gas deposits there mattered little to anyone, because prices were then so low and supplies so plentiful. No wonder that the Palestinians took their time recruiting British Gas (BG) -- a major player in the global natural gas sweepstakes -- to find out what was actually there. Only in 2000 did the two parties even sign a modest contract to develop those by-then confirmed fields.

BG promised to finance and manage their development, bear all the costs, and operate the resulting facilities in exchange for 90% of the revenues, an exploitative but typical "profit-sharing" agreement. With an already functioning natural gas industry, Egypt agreed to be the on-shore hub and transit point for the gas. The Palestinians were to receive 10% of the revenues (estimated at about a billion dollars in total) and were guaranteed access to enough gas to meet their needs.

Had this process moved a little faster, the contract might have been implemented as written. In 2000, however, with a rapidly expanding economy, meager fossil fuels, and terrible relations with its oil-rich neighbors, Israel found itself facing a chronic energy shortage. Instead of attempting to answer its problem with an aggressive but feasible effort to develop renewable sources of energy, Prime Minister Ehud Barak initiated the era of Eastern Mediterranean fossil fuel conflicts. He brought Israel's naval control of Gazan coastal waters to bear and nixed the deal with BG. Instead, he demanded that Israel, not Egypt, receive the Gaza gas and that it also control all the revenues destined for the Palestinians -- to prevent the money from being used to "fund terror."

READ MORE...

SHARE THIS ARTICLE...

Thursday, 26 February 2015

Report: Saudi Arabia Would Lend Israel Air Space for Strike on Iran

"The Saudi authorities are completely coordinated with Israel on all matters related to Iran," Channel 2 reported the unnamed European official as saying on Tuesday, reported The Jerusalem Post.

"The Saudis have declared their readiness for the Israeli Air Force to overfly Saudi airspace en route to attack Iran if an attack is necessary," the report said.

Saudi Arabia's eastern Persian Gulf border is only about 100 miles from Iran's Bushehr nuclear site.

The agreement does come with strings attached, though. Before Saudi Arabia will allow Israel to use its airspace, officials said that Israel needs to demonstrate "some sign of progress" in the ongoing peace talks on the issue of Palestinian statehood, reported the Jerusalem Post.

Middle Eastern countries like Saudi Arabia, Egypt, Qatar and the United Arab Emirates have expressed concern that a nuclear arms race could break out in the region if Iran were to successfully develop an atomic weapon.

The United States, along with Britain, France, Germany, China and Russia, are currently in the final stages of nuclear negotiations with Iran in hopes that a diplomatic deal can be reached to prevent Tehran from pursuing nuclear weapons.

READ MORE...

SHARE THIS ARTICLE...

Wednesday, 25 February 2015

Janet Yellen Is Freaking Out About ‘Audit The Fed’ – Here Are 100 Reasons Why She Should Be

Janet Yellen is very alarmed that some members of Congress want to conduct a comprehensive audit of the Federal Reserve for the first time since it was created. If the Fed is doing everything correctly, why should Yellen be alarmed? What does she have to hide? During testimony before Congress on Tuesday, she made “central bank independence” sound like it was the holy grail. Even though every other government function is debated politically in this country, Yellen insists that what the Federal Reserve does is “too important” to be influenced by the American people. Does any other government agency ever dare to make that claim? But of course the Federal Reserve is not a government agency. It is a private banking cartel that has far more power over our money and our economy than anyone else does. And later on in this article I am going to share with you dozens of reasons why Congress should shut it down.

The immense power wielded by the Federal Reserve is clearly demonstrated whenever Janet Yellen speaks publicly. On Tuesday, her comments about interest rates sent stocks to brand new record highs…

Yellen, in her semi-annual testimony before the Senate banking committee, used a word familiar to investors when she reiterated that the central bank will be “patient” on raising interest rates for the first time since the 2008 financial crisis. Traders took that as a sign that interest rates would remain unchanged until autumn.The Dow Jones Industrial Average rose 92.35 points (0.5%) to 18,209.19, while the Standard & Poors 500 gained 5.82 points (0.3%) to 2,115.48, both eclipsing Friday’s record closes.

But Yellen was also unusually defensive on Tuesday. The “Audit the Fed” bill that is being sponsored by Rand Paul (among others) has her really freaked out. The following comes from the Hill…

Appearing before the Senate Banking Committee, Yellen was on the defensive, as Republicans questioned how the Fed conducts monetary policy and Democrats put forward ideas for getting tougher on Wall Street.In the midst of all of it, Yellen generally argued the Fed was designed as an independent entity for a reason — and it would be best not to change it.“Central bank independence in conducting monetary policy is considered a best practice for central banks around the world,” she said. “Academic studies, I think, establish beyond the shadow of a doubt that independent central banks perform better.”

In fact, she went so far as to mention the “Audit the Fed” bill by name…

A GOP-controlled Congress has given the bill its best chances yet of passage, and that renewed interest led Yellen to deliver her most spirited opposition yet.“I want to be completely clear,” she said. “I strongly oppose Audit the Fed.”Yellen argued the audit measure would allow politicians to second-guess the Fed’s decisions, which, in turn, would weaken the central bank. And the ultimate victim of that process, she said, would be the U.S. economy.

So what is she so concerned about?

We are all accountable to someone.

What is so wrong about the Federal Reserve being accountable to Congress?

Why can’t we find out what is really going on inside the Fed?

And of course it isn’t just Yellen that is freaking out. Just consider these comments from Richard Fisher, the president of the Federal Reserve Bank of Dallas…

“It is always politically convenient to make something sound mysterious, if not malevolent, by claiming it is opaque,” Fisher said in a speech to the Economic Club of New York that is part of an effort by Fed officials to fight the legislation.“My suspicion is that many of those in Congress calling for ‘auditing’ the Fed are really sheep in wolves’ clothing,” he said. “Having proven themselves unable to cobble together with colleagues a working fiscal policy or to construct a regulatory regime that incentivizes rather than discourages investment and job creation — in other words, failed at their own job — they simply find it convenient to create a bogeyman out of an entity that does its job efficiently.”

Obviously this is a very, very touchy subject over at the Fed.

It is quite clear that they do not want the rest of us to be able to see what they are really up to.

And the truth is that if the American people really did know how the Federal Reserve works and what it has been doing behind closed doors, most Americans would want it shut down tomorrow.

At the end of the day, the reality of the matter is that we don’t even need a Federal Reserve. I really like how David Stockman made this point the other day…

At the end of the day, American capitalism does not need recycled political hacks like Jerome H. Powell or clueless school marms like Janet Yellen to thrive. If we need a Fed at all, it is the one designed by Carter Glass 100 years ago. That is, a “bankers bank” that was intended to provide standby liquidity at a penalty spread above the free market interest rate in consideration for good collateral originating from inventory and receivables in the real economy.Under that arrangement, there would be no monetary central planning or pointless attempts to manage the level of GDP, the number of new jobs, the rate of housing starts, the fluctuations of the CPI or the amplitudes of the business cycle. There would also be no pegging of the money market rate, no helping hand for Wall Street gamblers, no cheap debt to enable profligate politicians to kick-the-can down the road indefinitely.In short, what the nation really needs is not an “independent” Fed, but one that is shackled to a narrow and market-driven liquidity function. The rest of its current remit is nothing more than the self-serving aggrandizement of the apparatchiks who run it; and who have now managed to turn the nation’s vital money and capital markets into dangerous, unstable casinos, and the nations savers into indentured servants of a bloated and wasteful banking system.

The Federal Reserve has been around for just over a hundred years, and it has done an absolutely abysmal job for the American people.

I want to share with you some facts and figures that I have shared before, but they bear repeating. Please share this list of 100 reasons why the Federal Reserve should be shut down with everyone that you know…

#1 We like to think that we have a government “of the people, by the people, for the people”, but the truth is that an unelected, unaccountable group of central planners has far more power over our economy than anyone else in our society does.

#2 The Federal Reserve is actually “independent” of the government. In fact, the Federal Reserve has argued vehemently in federal court that it is “not an agency”of the federal government and therefore not subject to the Freedom of Information Act.

#3 The Federal Reserve openly admits that the 12 regional Federal Reserve banks are organized “much like private corporations“.

#4 The regional Federal Reserve banks issue shares of stock to the “member banks” that own them.

#5 100% of the shareholders of the Federal Reserve are private banks. The U.S. government owns zero shares.

#6 The Federal Reserve is not an agency of the federal government, but it has been given power to regulate our banks and financial institutions. This should not be happening.

#7 According to Article I, Section 8 of the U.S. Constitution, the U.S. Congress is the one that is supposed to have the authority to “coin Money, regulate the Value thereof, and of foreign Coin, and fix the Standard of Weights and Measures”. So why is the Federal Reserve doing it?

#8 If you look at a “U.S. dollar”, it actually says “Federal Reserve note” at the top. In the financial world, a “note” is an instrument of debt.

#9 In 1963, President John F. Kennedy issued Executive Order 11110 which authorized the U.S. Treasury to issue “United States notes” which were created by the U.S. government directly and not by the Federal Reserve. He was assassinated shortly thereafter.

#10 Many of the debt-free United States notes issued under President Kennedy are still in circulation today.

#11 The Federal Reserve determines what levels some of the most important interest rates in our system are going to be set at. In a free market system, the free market would determine those interest rates.

#12 The Federal Reserve has become so powerful that it is now known as “the fourth branch of government“.

#13 The greatest period of economic growth in U.S. history was when there was no central bank.

#14 The Federal Reserve was designed to be a perpetual debt machine. The bankers that designed it intended to trap the U.S. government in a perpetual debt spiral from which it could never possibly escape. Since the Federal Reserve was established 100 years ago, the U.S. national debt has gotten more than 5000 times larger.

#15 A permanent federal income tax was established the exact same year that the Federal Reserve was created. This was not a coincidence. In order to pay for all of the government debt that the Federal Reserve would create, a federal income tax was necessary. The whole idea was to transfer wealth from our pockets to the federal government and from the federal government to the bankers.

#16 The period prior to 1913 (when there was no income tax) was the greatest period of economic growth in U.S. history.

#17 Today, the U.S. tax code is about 13 miles long.

#18 From the time that the Federal Reserve was created until now, the U.S. dollar has lost 98 percent of its value.

#19 From the time that President Nixon took us off the gold standard until now, the U.S. dollar has lost 83 percent of its value.

#20 During the 100 years before the Federal Reserve was created, the U.S. economy rarely had any problems with inflation. But since the Federal Reserve was established, the U.S. economy has experienced constant and never ending inflation.

#21 In the century before the Federal Reserve was created, the average annual rate of inflation was about half a percent. In the century since the Federal Reserve was created, the average annual rate of inflation has been about 3.5 percent.

#22 The Federal Reserve has stripped the middle class of trillions of dollars of wealth through the hidden tax of inflation.

#23 The size of M1 has nearly doubled since 2008 thanks to the reckless money printing that the Federal Reserve has been doing.

#24 The Federal Reserve has been starting to behave like the Weimar Republic, and we all remember how that ended.

#25 The Federal Reserve has been consistently lying to us about the level of inflation in our economy. If the inflation rate was still calculated the same way that it was back when Jimmy Carter was president, the official rate of inflation would be somewhere between 8 and 10 percent today.

#26 Since the Federal Reserve was created, there have been 18 distinct recessions or depressions: 1918, 1920, 1923, 1926, 1929, 1937, 1945, 1949, 1953, 1958, 1960, 1969, 1973, 1980, 1981, 1990, 2001, 2008.

#27 Within 20 years of the creation of the Federal Reserve, the U.S. economy was plunged into the Great Depression.

#28 The Federal Reserve created the conditions that caused the stock market crash of 1929, and even Ben Bernanke admits that the response by the Fed to that crisis made the Great Depression even worse than it should have been.

#29 The “easy money” policies of former Fed Chairman Alan Greenspan set the stage for the great financial crisis of 2008.

#30 Without the Federal Reserve, the “subprime mortgage meltdown” would probably never have happened.

#31 If you can believe it, there have been 10 different economic recessionssince 1950. The Federal Reserve created the “dotcom bubble”, the Federal Reserve created the “housing bubble” and now it has created the largest bond bubble in the history of the planet.

#32 According to an official government report, the Federal Reserve made 16.1 trillion dollars in secret loans to the big banks during the last financial crisis. The following is a list of loan recipients that was taken directly from page 131 of the report…

Citigroup – $2.513 trillion

Morgan Stanley – $2.041 trillion

Merrill Lynch – $1.949 trillion

Bank of America – $1.344 trillion

Barclays PLC – $868 billion

Bear Sterns – $853 billion

Goldman Sachs – $814 billion

Royal Bank of Scotland – $541 billion

JP Morgan Chase – $391 billion

Deutsche Bank – $354 billion

UBS – $287 billion

Credit Suisse – $262 billion

Lehman Brothers – $183 billion

Bank of Scotland – $181 billion

BNP Paribas – $175 billion

Wells Fargo – $159 billion

Dexia – $159 billion

Wachovia – $142 billion

Dresdner Bank – $135 billion

Societe Generale – $124 billion

“All Other Borrowers” – $2.639 trillion

Morgan Stanley – $2.041 trillion

Merrill Lynch – $1.949 trillion

Bank of America – $1.344 trillion

Barclays PLC – $868 billion

Bear Sterns – $853 billion

Goldman Sachs – $814 billion

Royal Bank of Scotland – $541 billion

JP Morgan Chase – $391 billion

Deutsche Bank – $354 billion

UBS – $287 billion

Credit Suisse – $262 billion

Lehman Brothers – $183 billion

Bank of Scotland – $181 billion

BNP Paribas – $175 billion

Wells Fargo – $159 billion

Dexia – $159 billion

Wachovia – $142 billion

Dresdner Bank – $135 billion

Societe Generale – $124 billion

“All Other Borrowers” – $2.639 trillion

#33 The Federal Reserve also paid those big banks $659.4 million in “fees” to help “administer” those secret loans.

#34 During the last financial crisis, big European banks were allowed to borrow an “unlimited” amount of money from the Federal Reserve at ultra-low interest rates.

#35 The “easy money” policies of Federal Reserve Chairman Ben Bernanke have created the largest financial bubble this nation has ever seen, and this has set the stage for the great financial crisis that we are rapidly approaching.

#36 Since late 2008, the size of the Federal Reserve balance sheet has grown from less than a trillion dollars to more than 4 trillion dollars. This is complete and utter insanity.

#37 During the quantitative easing era, the value of the financial securities that the Fed has accumulated is greater than the total amount of publicly held debt that the U.S. government accumulated from the presidency of George Washington through the end of the presidency of Bill Clinton.

#38 Overall, the Federal Reserve now holds more than 32 percent of all 10 year equivalents.

#39 Quantitative easing creates financial bubbles, and when quantitative easing ends those bubbles tend to deflate rapidly.

#40 Most of the new money created by quantitative easing has ended up in the hands of the very wealthy.

#41 According to a prominent Federal Reserve insider, quantitative easing has been one giant “subsidy” for Wall Street banks.

#42 As one CNBC article stated, we are seeing absolutely rampant inflation in “stocks and bonds and art and Ferraris“.

#43 Donald Trump once made the following statement about quantitative easing: “People like me will benefit from this.”

#44 Most people have never heard about this, but a very interesting studyconducted for the Bank of England shows that quantitative easing actually increases the gap between the wealthy and the poor.

#45 The gap between the top one percent and the rest of the country is now the greatest that it has been since the 1920s.

#46 The mainstream media has sold quantitative easing to the American public as an “economic stimulus program”, but the truth is that the percentage of Americans that have a job has actually gone down since quantitative easing first began.

#47 The Federal Reserve is supposed to be able to guide the nation toward “full employment”, but the reality of the matter is that an all-time record 102 million working age Americans do not have a job right now. That number has risen by about 27 million since the year 2000.

#48 For years, the projections of economic growth by the Federal Reserve haveconsistently overstated the strength of the U.S. economy. But every single time, the mainstream media continues to report that these numbers are “reliable” even though all they actually represent is wishful thinking.

#49 The Federal Reserve system fuels the growth of government, and the growth of government fuels the growth of the Federal Reserve system. Since 1970, federal spending has grown nearly 12 times as rapidly as median household income has.

#50 The Federal Reserve is supposed to look out for the health of all U.S. banks, but the truth is that they only seem to be concerned about the big ones. In 1985, there were more than 18,000 banks in the United States. Today, there are only6,891 left.

#51 The six largest banks in the United States (JPMorgan Chase, Bank of America, Citigroup, Wells Fargo, Goldman Sachs and Morgan Stanley) have collectively gotten37 percent larger over the past five years.

#52 The U.S. banking system has 14.4 trillion dollars in total assets. The six largest banks now account for 67 percent of those assets and all of the other banks account for only 33 percent of those assets.

#53 The five largest banks now account for 42 percent of all loans in the United States.

#54 We were told that the purpose of quantitative easing is to help “stimulate the economy”, but today the Federal Reserve is actually paying the big banks not to lend out 1.8 trillion dollars in “excess reserves” that they have parked at the Fed.

#55 The Federal Reserve has allowed an absolutely gigantic derivatives bubble to inflate which could destroy our financial system at any moment. Right now, four of the “too big to fail” banks each have total exposure to derivatives that is well in excess of 40 trillion dollars.

#56 The total exposure that Goldman Sachs has to derivatives contracts is more than 381 times greater than their total assets.

#57 Federal Reserve Chairman Ben Bernanke has a track record of failure that would make the Chicago Cubs look good.

#58 The secret November 1910 gathering at Jekyll Island, Georgia during which the plan for the Federal Reserve was hatched was attended by U.S. Senator Nelson W. Aldrich, Assistant Secretary of the Treasury Department A.P. Andrews and a whole host of representatives from the upper crust of the Wall Street banking establishment.

#59 The Federal Reserve was created by the big Wall Street banks and for the benefit of the big Wall Street banks.

#60 In 1913, Congress was promised that if the Federal Reserve Act was passed that it would eliminate the business cycle.

#61 There has never been a true comprehensive audit of the Federal Reserve since it was created back in 1913.

#62 The Federal Reserve system has been described as “the biggest Ponzi scheme in the history of the world“.

#63 The following comes directly from the Fed’s official mission statement: “To provide the nation with a safer, more flexible, and more stable monetary and financial system.” Without a doubt, the Federal Reserve has failed in those tasks dramatically.

#64 The Fed decides what the target rate of inflation should be, what the target rate of unemployment should be and what the size of the money supply is going to be. This is quite similar to the “central planning” that goes on in communist nations, but very few people in our government seem upset by this.

#65 A couple of years ago, Federal Reserve officials walked into one bank in Oklahoma and demanded that they take down all the Bible verses and all the Christmas buttons that the bank had been displaying.

#66 The Federal Reserve has taken some other very frightening steps in recent years. For example, back in 2011 the Federal Reserve announced plans to identify “key bloggers” and to monitor “billions of conversations” about the Fed on Facebook, Twitter, forums and blogs. Someone at the Fed will almost certainly end up reading this article.

#67 Thanks to this endless debt spiral that we are trapped in, a massive amount of money is transferred out of our pockets and into the pockets of the ultra-wealthy each year. Incredibly, the U.S. government spent more than 415 billion dollarsjust on interest on the national debt in 2013.

#68 In January 2000, the average rate of interest on the government’s marketable debt was 6.620 percent. If we got back to that level today, we would be paying more than a trillion dollars a year just in interest on the national debt and it would collapse our entire financial system.

#69 The American people are being killed by compound interest but most of them don’t even understand what it is. Albert Einstein once made the following statement about compound interest…

“Compound interest is the eighth wonder of the world. He who understands it, earns it … he who doesn’t … pays it.”

#70 Most Americans have absolutely no idea where money comes from. The truth is that the Federal Reserve just creates it out of thin air. The following is how I havepreviously described how money is normally created by the Fed in our system…

When the U.S. government decides that it wants to spend another billion dollars that it does not have, it does not print up a billion dollars.Rather, the U.S. government creates a bunch of U.S. Treasury bonds (debt) and takes them over to the Federal Reserve.The Federal Reserve creates a billion dollars out of thin air and exchanges them for the U.S. Treasury bonds.

#71 What does the Federal Reserve do with those U.S. Treasury bonds? They end up getting auctioned off to the highest bidder. But this entire process actually creates more debt than it does money…

The U.S. Treasury bonds that the Federal Reserve receives in exchange for the money it has created out of nothing are auctioned off through the Federal Reserve system.But wait.There is a problem.Because the U.S. government must pay interest on the Treasury bonds, the amount of debt that has been created by this transaction is greater than the amount of money that has been created.So where will the U.S. government get the money to pay that debt?Well, the theory is that we can get money to circulate through the economy really, really fast and tax it at a high enough rate that the government will be able to collect enough taxes to pay the debt.But that never actually happens, does it?And the creators of the Federal Reserve understood this as well. They understood that the U.S. government would not have enough money to both run the government and service the national debt. They knew that the U.S. government would have to keep borrowing even more money in an attempt to keep up with the game.

#72 Of course the U.S. government could actually create money and spend it directly into the economy without the Federal Reserve being involved at all. But then we wouldn’t be 17 trillion dollars in debt and that wouldn’t serve the interests of the bankers at all.

#73 The following is what Thomas Edison once had to say about our absolutely insane debt-based financial system…

That is to say, under the old way any time we wish to add to the national wealth we are compelled to add to the national debt.Now, that is what Henry Ford wants to prevent. He thinks it is stupid, and so do I, that for the loan of $30,000,000 of their own money the people of the United States should be compelled to pay $66,000,000 — that is what it amounts to, with interest. People who will not turn a shovelful of dirt nor contribute a pound of material will collect more money from the United States than will the people who supply the material and do the work. That is the terrible thing about interest. In all our great bond issues the interest is always greater than the principal. All of the great public works cost more than twice the actual cost, on that account. Under the present system of doing business we simply add 120 to 150 per cent, to the stated cost.But here is the point: If our nation can issue a dollar bond, it can issue a dollar bill. The element that makes the bond good makes the bill good.

#74 The United States now has the largest national debt in the history of the world, and we are stealing roughly 100 million dollars from our children and our grandchildren every single hour of every single day in a desperate attempt to keep the debt spiral going.

#75 Thomas Jefferson once stated that if he could add just one more amendment to the U.S. Constitution it would be a ban on all government borrowing…

I wish it were possible to obtain a single amendment to our Constitution. I would be willing to depend on that alone for the reduction of the administration of our government to the genuine principles of its Constitution; I mean an additional article, taking from the federal government the power of borrowing.

#76 At this moment, the U.S. national debt is sitting at$18,141,409,083,212.36. If we had followed the advice of Thomas Jefferson, it would be sitting at zero.

#77 When the Federal Reserve was first established, the U.S. national debt was sitting at about 2.9 billion dollars. On average, we have been adding more than that to the national debt every single day since Obama has been in the White House.

#78 We are on pace to accumulate more new debt under the 8 years of the Obama administration than we did under all of the other presidents in all of U.S. history combined.

#79 If all of the new debt that has been accumulated since John Boehner became Speaker of the House had been given directly to the American people instead, every household in America would have been able to buy a new truck.

#80 Between 2008 and 2012, U.S. government debt grew by 60.7 percent, but U.S. GDP only grew by a total of about 8.5 percent during that entire time period.

#81 Since 2007, the U.S. debt to GDP ratio has increased from 66.6 percent to101.6 percent.

#82 According to the U.S. Treasury, foreigners hold approximately 5.6 trillion dollars of our debt.

#83 The amount of U.S. government debt held by foreigners is about 5 times larger than it was just a decade ago.

#84 As I have written about previously, if the U.S. national debt was reduced to a stack of one dollar bills it would circle the earth at the equator 45 times.

#85 If Bill Gates gave every single penny of his entire fortune to the U.S. government, it would only cover the U.S. budget deficit for 15 days.

#86 Sometimes we forget just how much money a trillion dollars is. If you were alive when Jesus Christ was born and you spent one million dollars every single day since that point, you still would not have spent one trillion dollars by now.

#87 If right this moment you went out and started spending one dollar every single second, it would take you more than 31,000 years to spend one trillion dollars.

#88 In addition to all of our debt, the U.S. government has also accumulated more than 200 trillion dollars in unfunded liabilities. So where in the world will all of that money come from?

#89 The greatest damage that quantitative easing has been causing to our economy is the fact that it is destroying worldwide faith in the U.S. dollar and in U.S. debt. If the rest of the world stops using our dollars and stops buying our debt, we are going to be in a massive amount of trouble.

#90 Over the past several years, the Federal Reserve has been monetizing a staggering amount of U.S. government debt even though Ben Bernanke once promised that he would never do this.

#91 China recently announced that they are going to quit stockpiling more U.S. dollars. If the Federal Reserve was not recklessly printing money, this would probably not have happened.

#92 Most Americans have no idea that one of our most famous presidents was absolutely obsessed with getting rid of central banking in the United States. The following is a February 1834 quote by President Andrew Jackson about the evils of central banking…

I too have been a close observer of the doings of the Bank of the United States. I have had men watching you for a long time, and am convinced that you have used the funds of the bank to speculate in the breadstuffs of the country. When you won, you divided the profits amongst you, and when you lost, you charged it to the Bank. You tell me that if I take the deposits from the Bank and annul its charter I shall ruin ten thousand families. That may be true, gentlemen, but that is your sin! Should I let you go on, you will ruin fifty thousand families, and that would be my sin! You are a den of vipers and thieves. I have determined to rout you out and, by the Eternal,(bringing his fist down on the table) I will rout you out.

#93 There are plenty of possible alternative financial systems, but at this point all 187 nations that belong to the IMF have a central bank. Are we supposed to believe that this is just some sort of a bizarre coincidence?

#94 The capstone of the global central banking system is an organization known as the Bank for International Settlements. The following is how I described this organization in a previous article…

An immensely powerful international organization that most people have never even heard of secretly controls the money supply of the entire globe. It is called the Bank for International Settlements, and it is the central bank of central banks. It is located in Basel, Switzerland, but it also has branches in Hong Kong and Mexico City. It is essentially an unelected, unaccountable central bank of the world that has complete immunity from taxation and from national laws. Even Wikipedia admits that “it is not accountable to any single national government.” The Bank for International Settlements was used to launder money for the Nazis during World War II, but these days the main purpose of the BIS is to guide and direct the centrally-planned global financial system. Today, 58 global central banks belong to the BIS, and it has far more power over how the U.S. economy (or any other economy for that matter) will perform over the course of the next year than any politician does. Every two months, the central bankers of the world gather in Basel for another “Global Economy Meeting”. During those meetings, decisions are made which affect every man, woman and child on the planet, and yet none of us have any say in what goes on. The Bank for International Settlements is an organization that was founded by the global elite and it operates for the benefit of the global elite, and it is intended to be one of the key cornerstones of the emerging one world economic system.

#95 The borrower is the servant of the lender, and the Federal Reserve has turned all of us into debt slaves.

#96 Debt is a form of social control, and the global elite use all of this debt to dominate all the rest of us. 40 years ago, the total amount of debt in our system (all government debt, all business debt, all consumer debt, etc.) was sitting at about 2 trillion dollars. Today, the grand total exceeds 56 trillion dollars.

#97 Unless something dramatic is done, our children and our grandchildren will be debt slaves for their entire lives as they service our debts and pay for our mistakes.

#98 Now that you know this information, you are responsible for doing something about it.

#99 Congress has the power to shut down the Federal Reserve any time that it would like. But right now most of our politicians fully endorse the current system, and nothing is ever going to happen until the American people start demanding change.

#100 The design of the Federal Reserve system was flawed from the very beginning. If something is not done very rapidly, it is inevitable that our entire financial system is going to suffer an absolutely nightmarish collapse.

Michael Snyder#100 The design of the Federal Reserve system was flawed from the very beginning. If something is not done very rapidly, it is inevitable that our entire financial system is going to suffer an absolutely nightmarish collapse.

SHARE THIS ARTICLE...

Tuesday, 24 February 2015

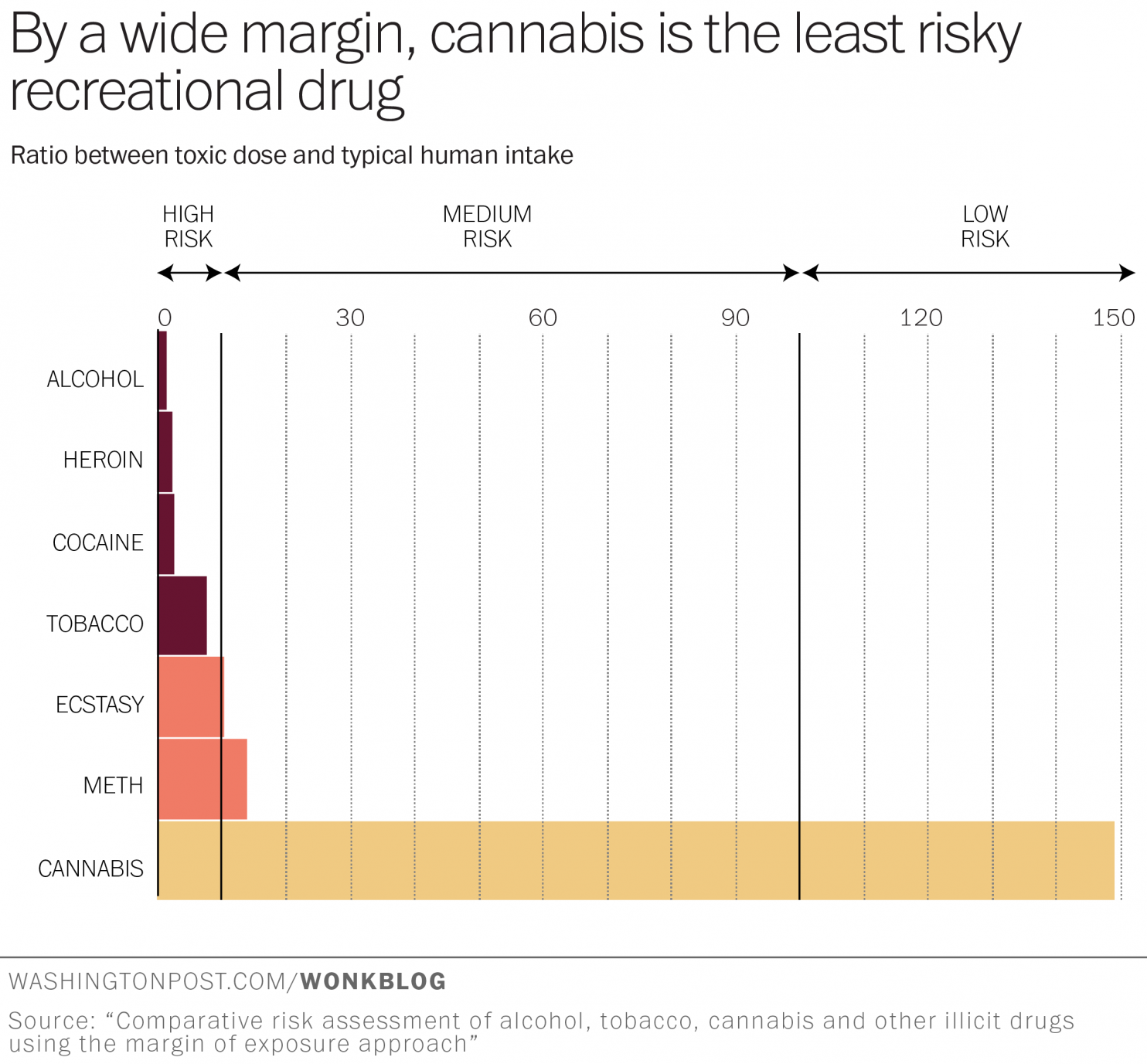

Cannabis 114 times less deadly than alcohol

Research published in the journal Scientific Reports finds that alcohol is the deadliest recreational drug, followed by heroin, cocaine, and tobacco. Cannabis, at the bottom of the list, is 114 times less deadly than alcohol. Christopher Ingraham of the Washington Post writes:

[I]ndividuals and organizations up in arms over marijuana legalization could have a greater effect on the health and well-being of this country by shifting their attention to alcohol and cigarettes. It takes extraordinary chutzpah to rail against the dangers of marijuana use by day and then go home to unwind with a glass of far more lethal stuff in the evening.

SHARE THIS ARTICLE...

Monday, 23 February 2015

America’s New Mafia: Big Pharma

What’s not funny is that America is the most medicated nation on earth, with some 70 percent of Americans taking prescription drugs—yet we have worse health outcomes than other industrialized countries. Part of the problem may be the drugs themselves. As Slate’s devastating expose on the fraud in clinical drug trials shows us: We don’t know much about the drugs we prescribe.

But as physicians, we have very little good information to go on. Even our most prestigious journals publish research based on falsified studies, according to Charles Seife, a journalism professor whose class spent a semester trying to figure out why the data don’t get corrected once research fraud comes to light. “As a result,” Seife writes, “nobody ever finds out which data is bogus, which experiments are tainted, and which drugs might be on the market under false pretenses.”

If no one knows which data is bogus, we obviously have a big problem in conventional medicine. Perhaps we shouldn’t be so focused on marketing shenanigans, and more concerned about the original study data before something becomes standard of care. Standard of care, of course, is driven by “research” that is incorporated into academic guidelines and is the basis of customer demand.

Understanding consumer demand takes very little study—just turn on the TV. Every year pharmaceutical companies spend over $3 billion on direct-to-consumer ads. These ads work: a patient who requests a specific drug will get it most of the time. (We are, by the way, the only country besides New Zealand that allows this.) But the question of how something becomes part of a recommended guideline is less obvious—and has a lot to do with pharmaceutical money paid to academic physicians in research and consulting fees.

Many of these physicians “leaders” then get to influence prescribing practices—since researchers and consultants are, well, experts. Consider the 2004 Cholesterol guidelines that resulted in an explosion in the use of statin drugs—eight out of nine of the doctors who wrote those guidelines were in receipt of money from statin manufacturers. The Harvard psychiatrist credited with hyping the use of stimulant drugs for ADHD—that has resulted in nearly 15 percent of our youth being medicated—received $1.6 million from producers of stimulant drugs. Prestigious medical journals—the ones that often define medical guidelines—allow physicians consulting for pharmaceutical companies or paid medical writers to extol the virtues of the drugs they are selling.

SHARE THIS ARTICLE...

Sunday, 22 February 2015

Dispute over the South China Sea could put East Asia at war again

In response, the US and the Philippines announced they would further strengthen their alliance to increase their military capacity. The Philippines have already given the US military access to bases on Philippine soil, two decades after the closing of the last American bases there.

The news about Chinese building projects and the possible military consequences have not yet been commented on by the Chinese media or by Chinese officials, but it seems clear that the reinforcements are yet another move in a long, steady game of escalation between the US and China.

The disputed maritime area may not be worth the risks. The natural and artificial features in the disputed areas of the South China Sea are generally too small and too far away from the mainland to sustain life, and many of the oil and gas fields in the disputed areas could also be drained from areas that are not disputed – avoiding conflict at least for the time being.

But there are reasons to believe that this escalation of military tension could still be very dangerous. The buffers that have prevented wars in South-East Asia and North-East Asia – such as strong norms of sovereignty – seem weaker in the disputed maritime areas, and worries are growing that a military build up could surge out of control.

War and peace

In the three decades after World War II, East Asia saw more conflict fatalities than any region in the world, and it was host to the postwar era’s three deadliest military conflicts: the Vietnam War, the Korean War and the Chinese Civil War.

But since the 1970s, things have changed dramatically, and in terms of battle-related fatalities, East Asia has been more peaceful than Europe, the Americas or any other area in the world.

This is partly down to the collective East Asian impetus for development that took root in the 1970s. A country cannot develop its economy sustainably if it is busy fighting wars and destroying important markets in its neighbouring countries. But there’s another buffer against open conflict in East Asia: a strong respect for sovereignty, which has held sway in the area for decades.

READ MORE...

SHARE THIS ARTICLE...

Subscribe to:

Comments (Atom)